QLD Land Tax And What It Means For Investors

There has been some confusion and questions posed to us in regard to the QLD land tax initiative.

In our opinion the initiative seems to be focussed on higher level investors with property owned in companies and trusts. We do not foresee a large impact for the great proportion of our clients, and it is our hope that the following information will put your minds at ease. There have been many changes over the last 30 years and there will be many more to come in the next 30 years.

As an investor, it is vital that we educate ourselves and seek advice from the relevant government sources and our trusted advisors. Basing decisions on information from the media and our colleagues, while no doubt having the best intentions, is not a recommended strategy.

Today We Look At

The facts of the policy

Some typical examples

How can we manage the change

The Facts

The new land tax policy is only based on the land portion of your property holdings. You will find your land value on your rates notice.

It does not include your principal place of residence (your home) no matter which State it is located in.

Threshold for Individuals is $600,000 in total land holding in Australia.

Threshold for companies and trusts is $350,000 in total land holdings in Australia.

The changes are from June 30th 2023 and will be based on land held 30th June 2022.

All holders of QLD property will need to create a Queensland State Revenue (QSR) Online account. This is a simple process (see video Create an account in QRO Online and verify your identity – YouTube)

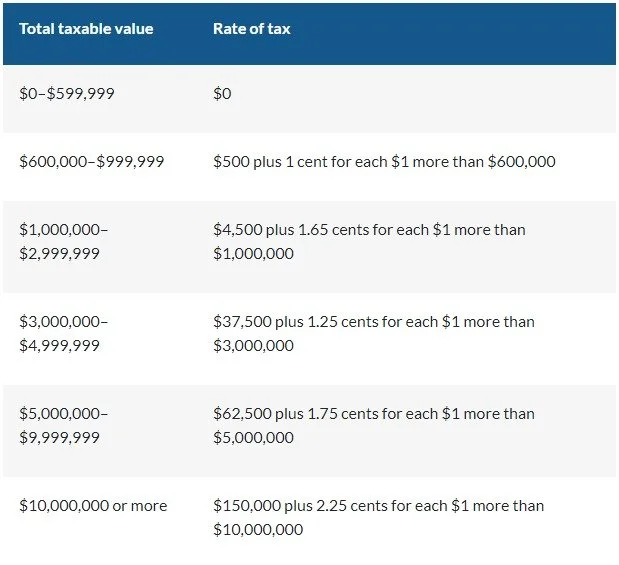

Rates Table as of 12th September 2022.

For more information on the facts please follow the link (Interstate properties and land tax | Environment, land and water | Queensland Government (www.qld.gov.au)

Example 1

John and Jenny Smith own the following properties:

-

Home: Sydney NSW • Land Component $700,000

Investment 1: Melbourne VIC • Land Component $500,000

Investment 2: Brisbane QLD • Land Component $500,000

-

Sydney NSW: $0

Melbourne: $500,000

Brisbane: $500,000

TOTAL: $1,000,000

-

=$500 + 1 cent for each $1 more than $600,000

=$500 + (1 cent x $400,000)

=$500 + $4,000

=$4,500

=(QLD Land Component ÷ Total land to be considered) x $4,500

=($500,000 ÷ $1,000,000) x $4,500

= (0.5) x $4,500

=$2,250

=$43.27 per week for the Brisbane investment property

-

= $43.27 increase .*Under the old rules the Brisbane property would have attracted $0 land tax as it was under the $600,000 threshold.

Example 2

Jack and Jill Jones own the following properties:

-

Home: Gold Coast QLD • Land Component $850,000

Investment 1: Sunshine Coast QLD • Land Component $400,000

Investment 2: Brisbane QLD • Land Component $550,000

Investment 3: Melbourne VIC • Land Component $300,000

-

Gold Coast QLD: $0

Sunshine Coast QLD: $400,000

Brisbane QLD: $550,000

Melbourne VIC: $300,000

TOTAL: $1,250,000

-

=$4,500 + 1.65 cent for each $1 more than $1,000,000

=$4,500 + (1.65 cent x $250,000)

=$4,500 + $4,125

=$8,625

=(QLD Land Component ÷ Total land to be considered) x $8,625

=($950,000 ÷ $1,250,000) x $8,625

=(0.76) x $8,625

=$6,555

=$52.92 per week for the Sunshine Coast property

=$73.08 per week for the Brisbane property

-

=$43.27 increase .*Under the old rules the Brisbane property would have attracted $0 land tax as it was under the $600,000 threshold.=$49.13 Increase. *Under the old rules the QLD properties would have attracted $4,000 land tax.

=$20.63 increase per week for the Sunshine Coast property

=$28.50 increase per week for the Brisbane property

How Can We Manage The Changes?

Whether you have an existing portfolio that includes property in QLD and the land was already over the $600,000 threshold or under the threshold, the increase is marginal in comparison to the capital growth and over all yield you should be achieving.

For example – if your capital growth rate was 7.2% it would equate to a growth of $7,200 for every $100,000 invested.

Ensuring that your tenant is paying above market rent for the property and ensuring that you have the best mortgage products are key to managing such changes.

It is important to note that land tax is currently a deductable expense so please ensure you speak with your accountant.

Conclusion

Managing the cash flow of a property starts with the fundamentals.

Did you negotiate the purchase price under market value?

– This reduces your running costs and increases rental yield.

Is your property highly sort after for prospective tenants?

– This gives you the ability to set above market rent.

Do you have some extra ‘wiggle’ room for such changes in your personal budget?

– This gives you the peace of mind that you can absorb future increases such as taxes, interest rates and insurances.

Just like running any business, investing success is achieved by surrounding yourself with key advisors and taking the time to understand your portfolio.

If you would like to discuss these changes or any other aspects of property, please contact us and we will welcome your call.

Source – Queensland Government – Land Tax, Australian Tax Office. Disclaimer: The views of the author, either expressed or implied, may not represent the views of Astute Property Network Pty Ltd. Every effort is made to ensure the accuracy of the information contained within this document. The information is not intended as financial advice and does not take into account your personal financial position or needs. You should always consult your financial specialist before making any changes to your finances.